Single clients generally face bigger financial limitations than married couples in retirement income planning, such as higher living costs, less savings, and restricted benefits. Help these clients effectively manage their retirement through education, special budgeting and savings strategies, investments, and other options that may be available to them.

In a retirement planning world oriented towards couples, the 42% of American seniors who are single are likely to face more significant retirement planning challenges than couples. As more investors enter retirement alone or find themselves widowed or divorced early in retirement, advisors are increasingly likely to see more single people near and in retirement in need of financial advice.

“Singles not only have many of the expenses of couples, but they also lack the ability and capacity to save as much,” says Jeff Nauta, CFA, CFP, CAIA of Henrickson Nauta Wealth Advisors in Belmont, Mich. “Singles can only save half as much through tax advantaged vehicles. In addition, savings and investing can take a back seat for many singles, especially women who have been through a divorce.”

A 2014 U.S. Census Bureau study reports that 4.3% of the 65+ population has never been married, 26.3% are widowed, and 9.9% are divorced. Factors contributing to the increase in retired singles include rising rates of midlife divorce, longer life spans of women versus men, and increases in the rates of those who have never married.

When working with singles planning for retirement, there are a number of factors to keep in mind, including:

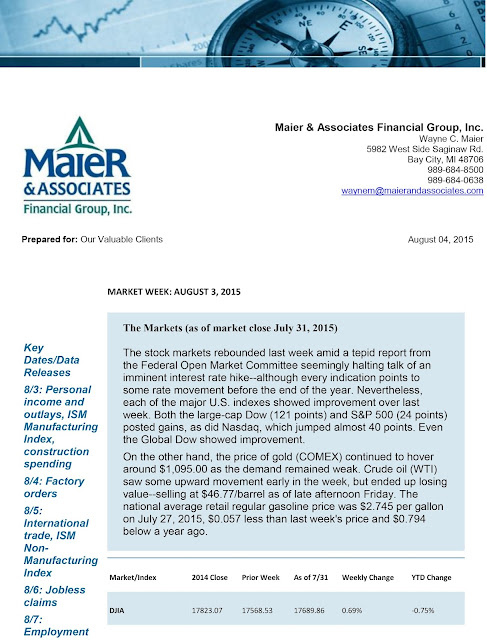

1. Retirement expenses likely to remain high

A 2012 National Bureau of Economic Research report found that married couples may save up to

10 times as much (or more) as single people ($111,600 versus $12,500) for retirement. Costs of living for single people are much higher than for married individuals because, on a per-person basis, a single person spends 70% to 75% of what a couple spends.

Many fixed costs in retirement are not that much lower for single people than for couples. For instance, many couples can get by on one car in retirement, saving money by getting rid of a second car. That’s not an option for most retired singles, who need a car for transportation. And while a single person may be able to live in a smaller house, apartment, or condo, that living space is not likely to be half the expense of what it would cost to house a married couple.

Singles, especially those who don’t have children, may have a habit of spending freely and will need guidance around budgeting in retirement, said Andrew Wang, portfolio manager and senior vice president at Runnymede Capital Management, Inc. “Many singles are spenders rather than savers because they do not need to worry about costs like education and wedding costs for children, so budgeting and projecting expenses after retirement is important,” he added.

2. Savings opportunities limited

While single individuals obviously have the same access to retirement planning vehicles, such as IRAs and 401(k)s, as couples do, they can’t save as much as couples but face higher expenses. That’s why it’s important for single retirees to save as much before retirement as possible.

“For single clients, it is imperative to come up with a very coordinated approach to saving for retirement,” says Elle Kaplan, CEO of Lexion Capital Management LLC in New York. “Ultimately, those savings become a paycheck that has to support that client from the day she retires until her last day on earth. The plan should include a detailed analysis that discusses how much can safely be spent each year to have a comfortable retirement, taking into account a variety of different market scenarios.”

Nauta agreed, saying, “Single clients can only save half as much in tax-deferred vehicles as married couples can and with potential expenses higher, they need to save more, which isn’t always easy.”

A report from Bank of Montreal Financial Group,

“Single in Retirement,” notes that many single retirees have to devote a larger share of their income towards basic needs such as shelter and transportation, leaving less for retirement savings. Inflation and longevity can take a higher toll on singles, raising the stakes in terms of saving more as early as possible. These factors also may mean that single people may have to work longer to amass sufficient savings to retire with a lessened longevity risk.

3. Social Security options more restricted

Single individuals have fewer options when it comes to taking Social Security. For most, the decision rests solely on when to take it. That is dependent upon a number of factors, but in many cases it makes sense to wait as long as possible to receive the maximum benefit, since single retirees have no other Social Security benefit to rely on.

Divorced women who were married for 10 years or more and haven’t remarried before age 60 are entitled to claim their ex-spouse’s benefit, Nauta noted. While some divorcees mistakenly believe that doing so will impact what their ex-spouse can receive from Social Security, that isn’t the case. For many women, especially those who took time off from work to take care of their children, that benefit may be significantly more than they could claim on their own.

4. Emergency savings needs greater

Without a second income and savings in the picture or survival benefits, singles planning for retirement or in retirement need to establish and maintain larger emergency funds. This is important both before and during retirement.

Before retirement, if a single person loses their job, there is no other income to fall back on. In this economy, it can take a prolonged job search, especially for a person in their 50s or 60s, and any new job may come with a lower salary and reduced benefits.

Nauta typically recommends a three-to-six-month emergency fund for couples. For a single person, that emergency fund should be six to 12 months, depending on the specific circumstances of that person’s job and finances.

5. Asset allocation decisions turn on risk tolerance

While asset allocation decisions aren’t that different for singles over couples—in fact they may be simplified because just one client is involved in making the decisions rather than two—singles may have a lower risk tolerance, because there is no other income or stream of retirement savings or pension to depend on.

“You have the same risks as far as investment risk, longevity risk, sequence of returns risk, inflation risk, long-term care, and death risk, ” said Richard Reyes, CFP, of the Financial Quarterback in Maitland, Fla. “However, many single individuals tend to believe that the risks inherent to a couple are not associated with those of single individuals. Individuals often think that no one is dependent on them or since they have been alone for so long that they will be able to take care of themselves forever.”

6. Risk management and estate issues need careful attention

Single retirees may have a greater need for additional insurance coverage. Before retirement, disability insurance can be helpful in case of an illness or injury that necessitates time off from work. During retirement, long-term care insurance can help pay for in-home or nursing home care, Nauta said, without depleting savings that may be needed in later years.

In terms of estate planning, make sure all documentation is thorough and is updated frequently as circumstances change, says Wang. “On investment accounts, singles should designate beneficiaries on their retirement accounts and maintain an appropriate will or a revocable living trust to control the ultimate disposition of his or her property at death,” he said. “Like married couples, singles should also have durable powers of attorney for financial matters and health care decisions. This should include a health care directive—or ‘living will’—to provide for management and health care decisions at the end of life. In the absence of immediate family, many singles can benefit by working closely with an advisor.”

7. Circumstances may change

While many individuals enter retirement as singles, that situation may change with co-habitation or remarriage, notes Reyes. “It’s important for single individuals to understand they might not be single forever,” he said. “They too can get married in later years, sometimes without them even intending or planning it.”

Of course, if the situation does change, it’s a good idea to consider a prenuptial agreement in the case of a remarriage or later first marriage so that both parties can protect assets that they are bringing into the marriage. A remarriage is a good time to re-examine estate planning documents as well.

Final advice on creating a solid retirement plan with single clients

Single clients face different challenges from those of married couples, so it is important to be aware of the variables they face and take those into consideration when crafting financial and investing plans. In the final analysis, as Brad Bofford, a partner with Financial Principles in Fairfield, N.J., noted, “The single client must be typically more active in their own planning since they do not have a partner to depend on, which relates not only to the monetary standpoint, but also administratively.”

Maier & Associates Financial Group is here to help!

At Maier & Associates, we are committed to helping you manage your finances as you strive to achieve your financial goals today, tomorrow, and many years down the road. Your financial success is important to us, which is why we create a wealth management strategy designed to meet your personal financial goals and dreams. Visit our website at

http://maierandassociates.com/ or simply give us a call at

(800) 282-4503.

Follow Us:

Facebook,

Twitter,

Google +